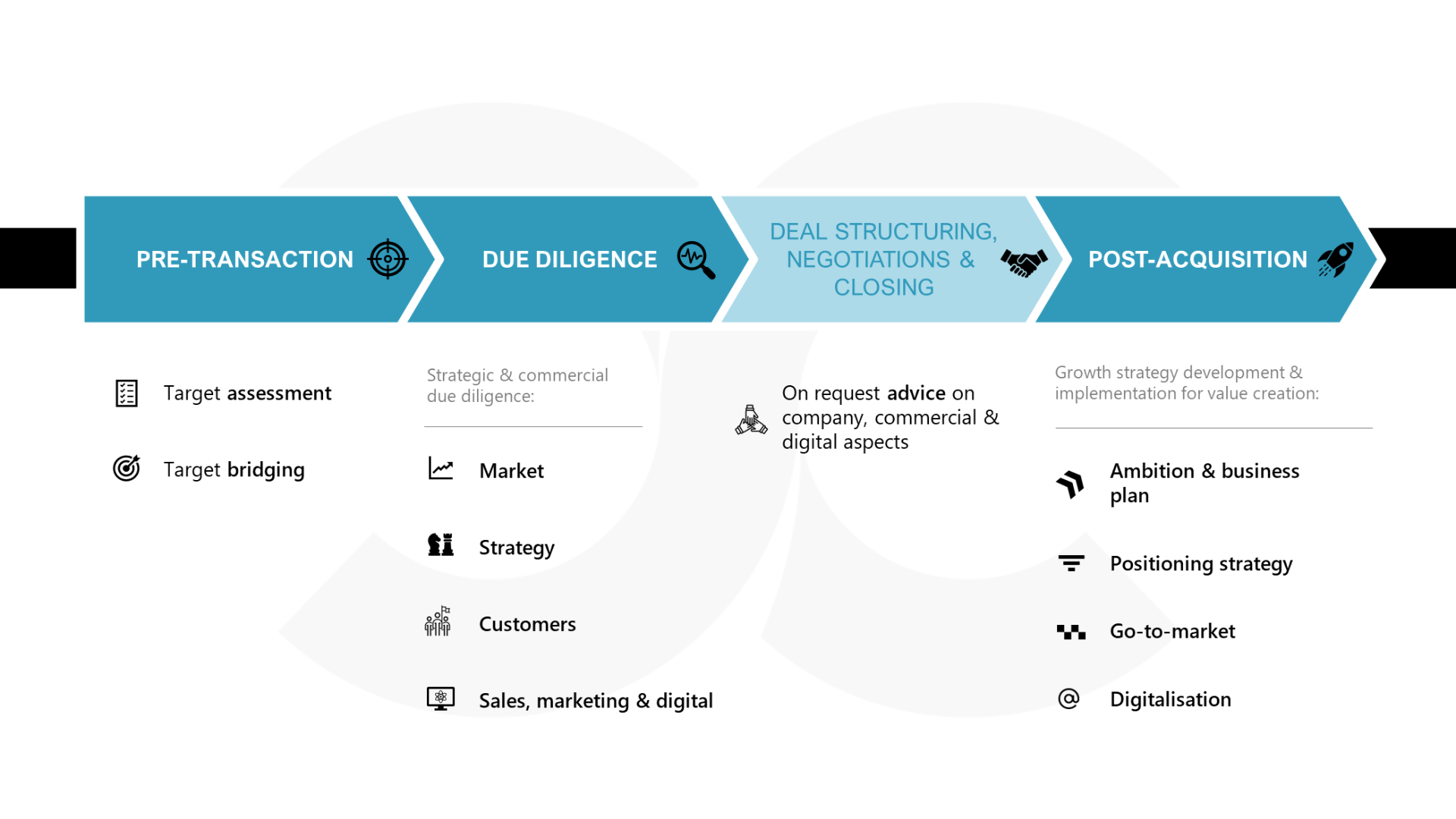

Strategic & commercial due diligence

Strategic and commercial due diligence is becoming an increasingly indispensable part of deals. We gladly help you understand the target organization down to the last detail from the strategic-commercial perspective. We analyze and assess a wide range of commercially relevant factors from a dual perspective: from within the company itself (inside-out) on the one hand, and from an external view (outside-in) on the other.

Our strategic-commercial due diligence focuses on four dimensions:

Market

- What does the market look like, and what are the main drivers and dynamics?

- How is the market structured and segmented?

- What are the current trends and evolutions, and what are the expectations for the future of the market?

- Who are the main competitors, how do they differentiate themselves and how do they relate to the organization?

Strategy

- What does the organization’s current business model look like and what are its various revenue streams?

- What is the ambition of the organization? To what extent is the business plan consistent with the stated ambition?

- What products, services and brands does the portfolio include?

- What is the positioning of the company or brand? How strong and future-proof is it?

Customers and stakeholders

- Who are the current target audiences, B2B and B2C, and what do we know/not know about them? What are their needs, frustrations and expectations as well as demographic characteristics?

- What kind of customer experience does the organization offer?

- What future potential does the organization have within existing and/or new target groups?

Sales, marketing & digital

- How does the organization’s sales and marketing channel mix look like, online/digital and offline? How effective and performant is it?

- How digitally developed is the organization? What is the digital footprint today and what are opportunities for the future?

Our answers to these questions, in addition to our well-founded advice including recommendations and watch-outs, are summarized in a clear yet detailed report that offers added value for all parties: for the target organization, this entails an in-depth SWOT at strategic-commercial level, for the investor it is an objective view on the business plan. We also facilitate a smooth cooperation between both parties, acting as a pivotal figure and preparing both for future growth.